Cannabis is a growing industry in the US, and is now legal for adult recreational use in more than 15 states with more passing legislation to legalize it’s sale for medical use. Recently Forbes published an article stating that the legal cannabis market is projected to be worth $43 billion by 2025. So as dispensaries become more commonplace we wondered, how are they viewed by consumers? Are people visiting them with the same frequency as liquor and drug stores?

Using the PureSpectrum Instant Insights Platform to target respondents in only the states with legalized recreational use, we asked adults about their cannabis purchasing behavior. After fielding was completed, we were provided with both high-quality data and instant, digestible insights showing that dispensaries are only being frequented by a small percentage of adults who are legally allowed to purchase from them.

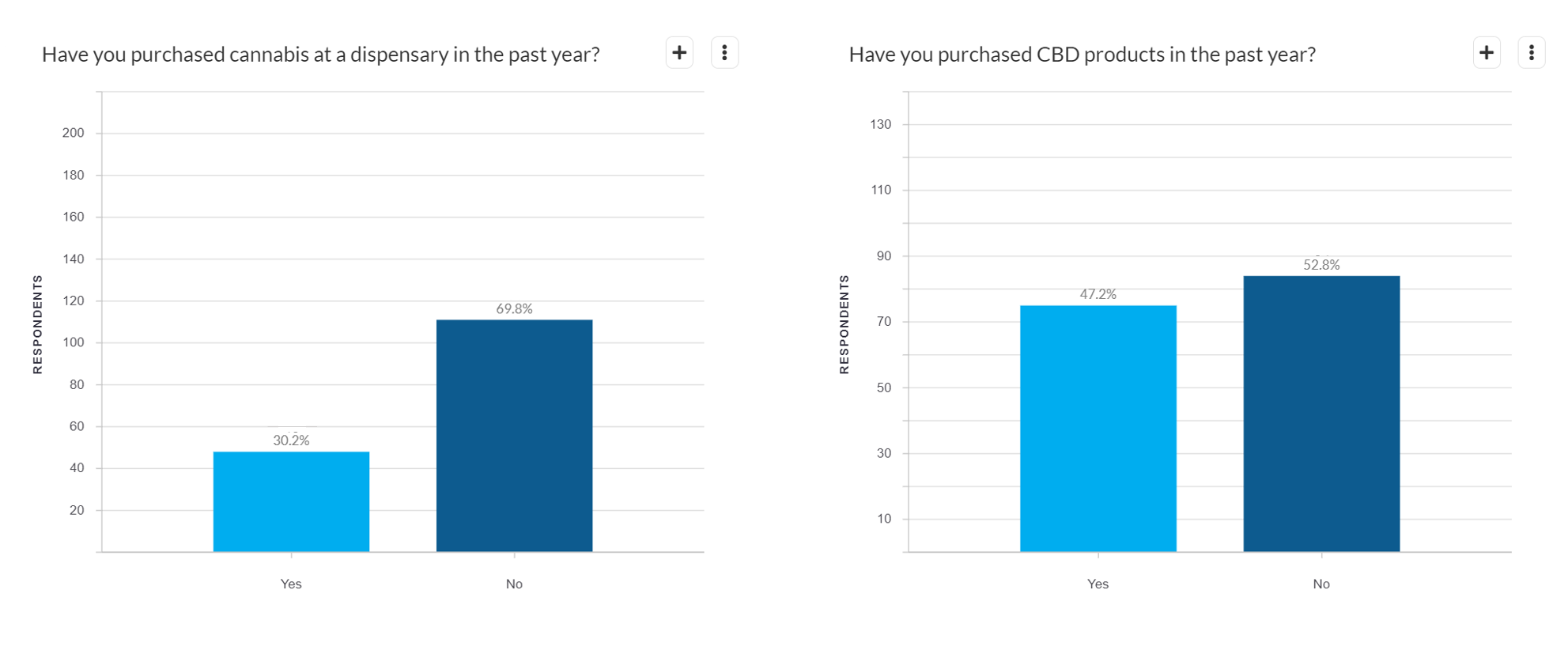

Only 30% of respondents had purchased cannabis at a dispensary in the past year but almost 50% had purchased a CBD product. Of the 70% of respondents who don’t purchase cannabis, almost 50% of them reported taking prescription pain medication. This shows that consumers are aware of CBD’s potential pain relief benefits but are much more comfortable taking prescription pain medicine than cannabis for pain management.

Source: PureSpectrum Insights Platform

When we asked our respondents why they hadn’t purchased cannabis, many lacked education or know-how. Over a quarter of respondents didn’t know how or felt intimidated to visit a dispensary. 16% of respondents didn’t even know it was legal where they lived.

If Forbes’ $43 billion cannabis market projection is to be accurate, it seems that a lot of marketing dollars will be needed to educate new buyers. There are still outdated views around cannabis and simple signage and billboards will not convert a majority of adults. If cannabis is to grow in mainstream popularity, consumers need to be educated on health benefits, pain relief, and stress management much like what was done around the marketing of CBD and prescription drugs.

Want to learn more about running your own survey? See how easy it is on our Insights Platform.

Interested in getting access to this data? Email us at marketing@purespectrum.com

Methodology

PureSpectrum interviewed 159 consumers between July 29, 2021, and August 02, 2021, using the PureSpectrum Insights Platform. The platform is integrated with the PureSpectrum Marketplace which combines proprietary measurement tools and third-party data validation to quickly collect high-quality insights. The study targeted consumers within Alaska, Arkansas, California, Colorado, Florida, Illinois, Maine, Maryland, Massachusetts, Michigan, Missouri, Nevada, Oklahoma, Oregon, Washington and consisted of a general population audience of 18+ years old. This study uses a 95% confidence level to examine the data.