Most morning routines, like other aspects of life, have changed since the advent of COVID-19. But as fall begins, some Americans have returned to the office and school, while others remain remote or in hybrid. With morning routines in flux, we surveyed coffee drinkers to see if these rituals are altering too.

America’s Morning Ritual

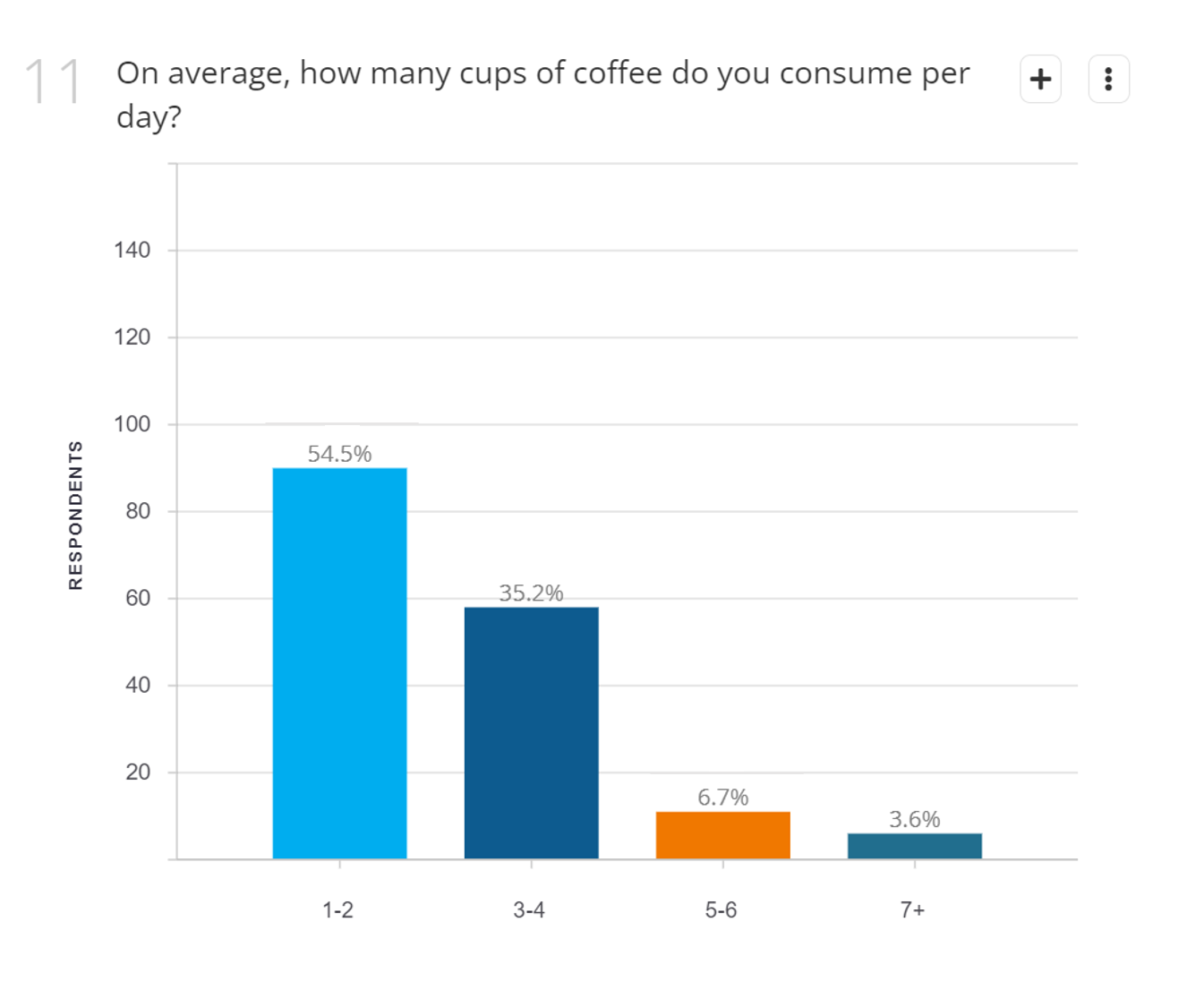

One thing is for certain, America’s love for coffee and caffeinated beverages doesn’t seem to be waning. A third of coffee drinkers call the beverage a necessity. Another third of respondents believe they drink more coffee than they did a year ago. And on average, 55% of Americans who consume coffee report drinking 1-2 cups a day and 35% report drinking 3-4.

Source: PureSpectrum Insights Platform

At-Home Coffee Habits

38% of Americans make coffee in their homes every single morning. Looking at their preferred methods of brewing, people want their cup of joe quick and easy. Nearly 50% of homebrewers prefer to use a drip coffee machine, followed by 30% who use a Kcup machine and 26% who use coffee pods. More laborious methods like french presses and pour over are only used by 12% of respondents. However, using the Insights Platform to filter by age group, we learned that 44% of 18-24-year-olds actually prefer making their own cold brew as compared to other methods.

Source: PureSpectrum Insights Platform

Coffee Shop Habits

Only 10% of Americans report purchasing coffee every day. But 36% say they spend more on coffee now than they did a year ago. The largest amount of respondents in our survey (20%) say they only purchase coffee once a week. When asked what type of shop they patronize, responses were very evenly split. A third prefer chains, another third prefer independent/local stores, and the final third purchase from both types of establishments.

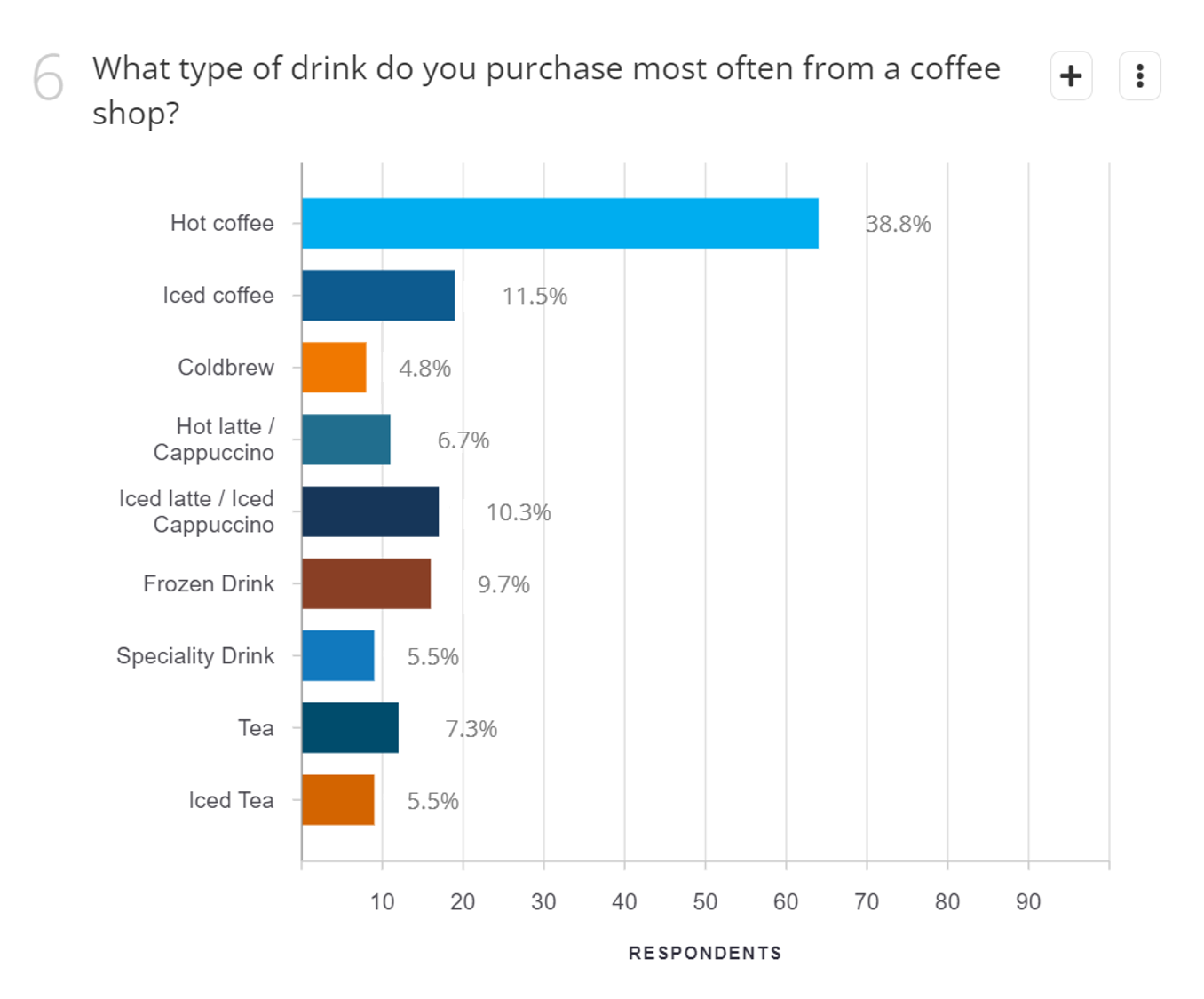

So what drinks are Americans purchasing when they go out? The largest majority of our respondents (39%) keep it simple with hot coffee followed by 12% who say they prefer iced coffee.

Source: PureSpectrum Insights Platform

But this doesn’t mean Americans don’t want to also add a little pumpkin spice to their autumn mornings. 36% of respondents say they often purchase seasonal beverages when they are available. And even more (40%) of respondents say they often purchase food with their coffee.

Staying Caffeinated

America’s caffeine habits don’t stop at coffee. 56% of respondents regularly drink soda and 45% regularly drink iced tea. Another 38% regularly choose hot tea and almost 30% drink hot cocoa. So no matter what their morning routine is this fall, Americans are likely to be well-caffeinated.

Want to learn more about running your own survey? See how easy it is on our Insights Platform.

Interested in getting further details about this data set? Email us at marketing@purespectrum.com

Methodology

PureSpectrum interviewed 165 online respondents on September 29, 2021, using the PureSpectrum Insights Platform. The platform is integrated with the PureSpectrum Marketplace which combines proprietary measurement tools and third-party data validation to quickly collect high-quality insights. The study fielded in less than 2 hours and targeted respondents within the United States and consisted of a general population audience of 18+ years old. This study uses a 95% confidence level to examine the data.

About PureSpectrum

PureSpectrum offers a complete end-to-end market research and insights platform, helping insights professionals make decisions more efficiently, and faster than ever before. Awarded MR Supplier of the Year at the 2021 Marketing Research and Insight Excellence Awards, PureSpectrum is recognized for industry-leading data quality. PureSpectrum developed the respondent-level scoring system, PureScore™, and believes their continued success stems from their talent density and dedication to simplicity and quality. In the few years since its inception, PureSpectrum has been named one of the Fastest Growing Companies in North America on Deloitte’s Fast 500 since 2020, and ranked for three years in a row on the GRIT Top 50 Most Innovative List and the Inc. 5000 lists.