It has been predicted that the COVID-19 lockdowns have and will continue to create a baby boom in America. While many Americans have adapted to shopping and gathering online, we wondered if new and expectant parents are doing so too? What platforms are currently influencing parents’ purchases? Using the PureSpectrum Insights Platform, we polled parents of preschool age and younger to better understand what the top baby and infant buying trends are and how parents feel about them.

1. New vs. Hand-Me-Downs

While many Americans report making efforts to be green, most parents do not want to recycle baby products. When asked if they prefer to buy new goods vs. get hand-me-downs when possible, 87% of parents prefer to buy new.

And where are they going to purchase these new products? Only 35% of parents we polled said they primarily shop in-store. Walmart is the retailer patronized most often by the largest percentage of our respondents (35%). Parents then look to Amazon (29%), Target (16%), and Macy’s (6%) for a majority of their baby purchases.

2. What Parents Want

When asked what’s the deciding factor when choosing baby products, 34% of parents said safety. 27% next identified price as the most important factor followed by 14% who depend on brand names to help guide purchases. This data was corroborated by the fact that when allowed to free answer a word that best describes what affects baby purchases, respondents also gravitated towards safety, quality, good, and price. Below is an example of the PureSpectrum Insights Platform’s word cloud feature.

Source: PureSpectrum Insights Platform

But how do parents determine what products are the safest, best quality, or best-priced? More and more are going online to research and learn. 48% of respondents say they watch parenting videos on Youtube. 38% read parenting blogs and 26% belong to online parenting forums. These online social interactions are shaping and influencing purchasing decisions. 32% of parents say they have purchased from brands that targeted them on social media, 27% have purchased brands recommended on a parenting forum and 22% have purchased products after seeing a parenting influencer talk about them.

3. Baby Subscription Services

Another way that parents are being introduced to new brands and products is through the advent of subscription services. We’ve previously studied the popularity of food and wine subscriptions and baby products seem to be no different. 52% of parents have purchased at least one subscription service. The most popular type of subscription is for clothes followed by toys, food, and diapers. Interestingly, when using the PureSpectrum Insights Platform to filter respondents by gender, more fathers than mothers have purchased subscription services for their babies.

Source: PureSpectrum Insights Platform

4. Babies Online

So if parents are online, does that mean babies are too? 58% of parents say they will share pictures of their babies on their own social media accounts. 20% of parents say their babies will have specific dedicated social media accounts. Only 29% of parents do not want their babies to have a social media presence. A majority (64%) of parents also plan or have recently hosted an online baby registry and 50% will host another if they have subsequent children.

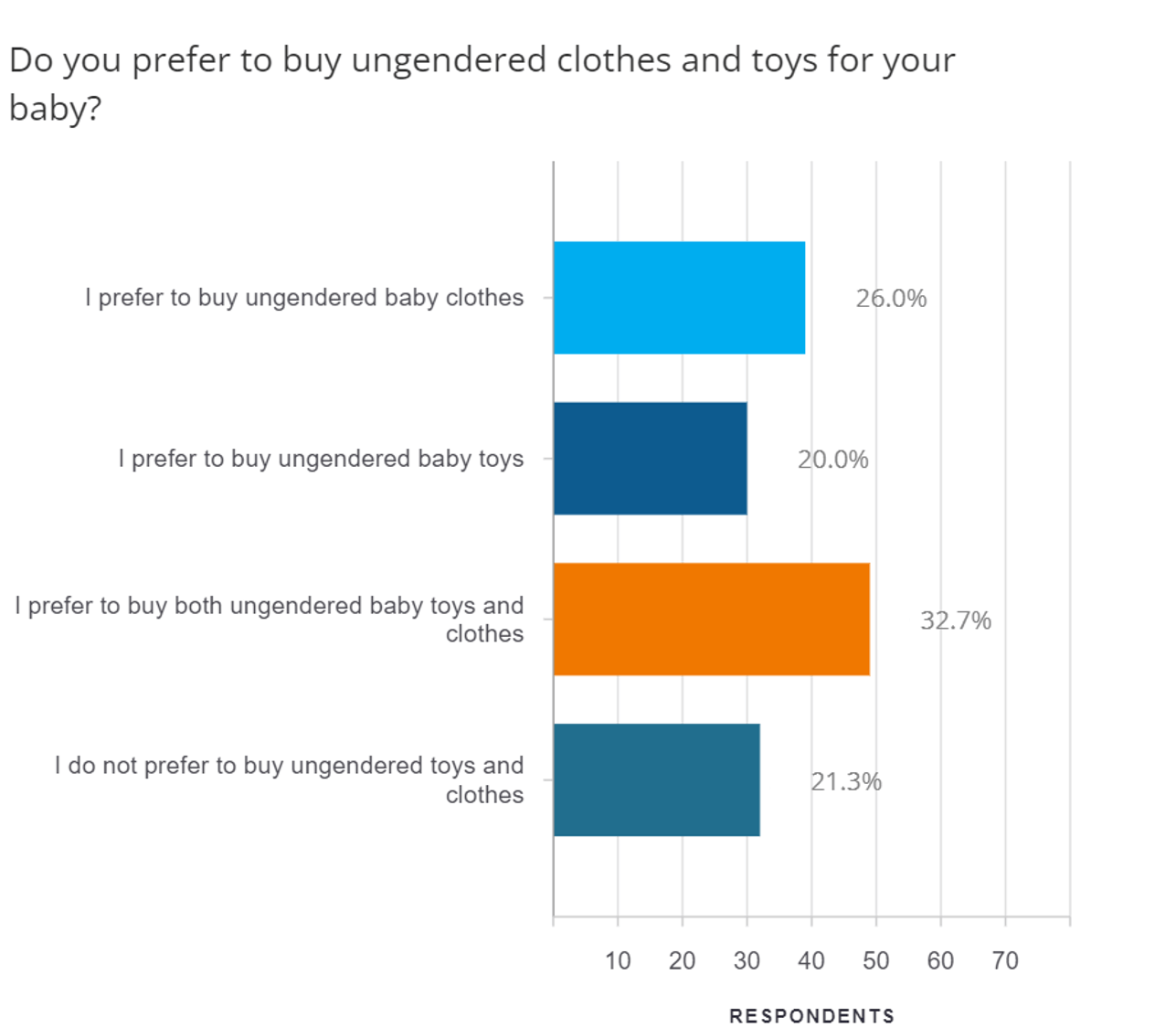

5. Gender-Neutral

Children’s toys were recently in the news because California’s Governor signed a law mandating that large department stores must have a gender-neutral toy section. While this law is the first of its kind, it is in line with the preferences of the parents that we polled. Only 21% of parents said they prefer to buy gendered toys and clothes for their babies. It will be interesting to see if this number dwindles further as retailers and manufacturers expand their gender-neutral baby product offerings

Source: PureSpectrum Insights Platform

Curious to dive deeper into these trends and our corresponding data? Email us at marketing@purespectrum.com

Want to learn more about running your own survey? See how easy it is on our Insights Platform.

Methodology

PureSpectrum interviewed 155 online respondents on October 8, 2021, using the PureSpectrum Insights Platform. The platform is integrated with the PureSpectrum Marketplace which combines proprietary measurement tools and third-party data validation to quickly collect high-quality insights. The study fielded in less than 2 hours and targeted parents within the United States and consisted of a general population audience of 18+ years old. This study uses a 95% confidence level to examine the data.

About PureSpectrum

PureSpectrum offers a complete end-to-end market research and insights platform, helping insights professionals make decisions more efficiently, and faster than ever before. Awarded MR Supplier of the Year at the 2021 Marketing Research and Insight Excellence Awards, PureSpectrum is recognized for industry-leading data quality. PureSpectrum developed the respondent-level scoring system, PureScore™, and believes their continued success stems from their talent density and dedication to simplicity and quality. In the few years since its inception, PureSpectrum has been named one of the Fastest Growing Companies in North America on Deloitte’s Fast 500 since 2020, and ranked for three years in a row on the GRIT Top 50 Most Innovative List and the Inc. 5000 lists.